In January, the COVID-19(coronavirus) broke out in China. On Feb 3rd, the first trading day after the Spring Festival, Chinese stocks suffered a large sell-off. After that, stocks began to bounce for the next three weeks. GEM Index bounced back hit new highs on the third trading day and the third trading week respectively, demonstrating confidence in the Chinese government's control of the outbreak and the future growth of the Chinese economy.

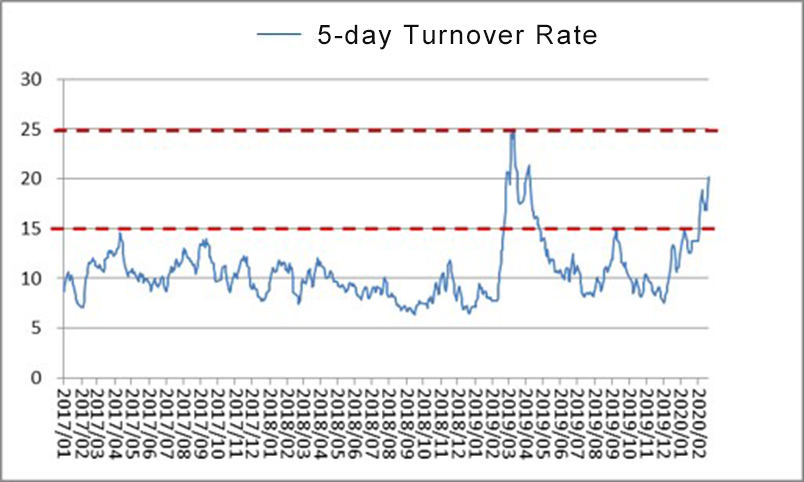

In the last week of February, 5-day turnover rate was close to the red line(25%), and the driving force of liquidity was coming to an end. In addition, the spread of coronavirus abroad exceeded expectations, so the stocks dropped rapidly.

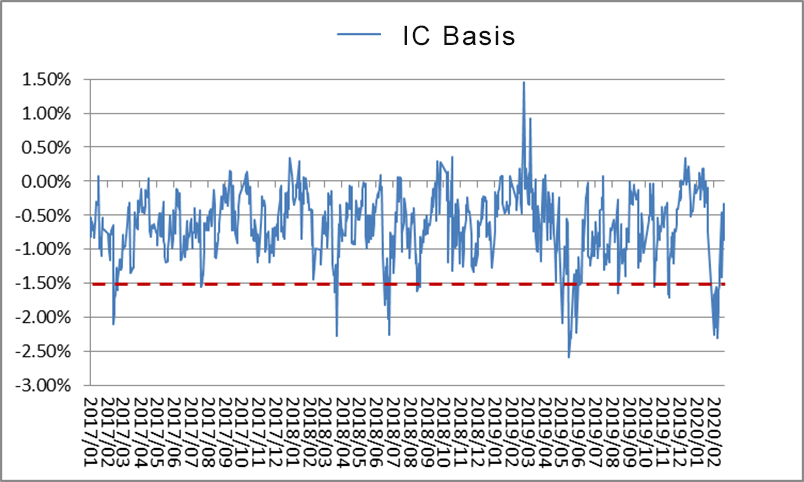

Source: Wind, Rosefinch, 2020/02/28

Recently, financial market reflects a shift from risk aversion to concerns about economic recession. By Feb 28th, US stocks have closed down for six consecutive trading days. Given that the current valuation of US stocks is still higher than the historical average, the short-term vent may not be over. It is still necessary to closely follow the situation of the overseas outbreak and its impact on the economy.

By the time the outbreak began overseas, China was past its darkest hour: the outbreak outside Hubei province had improved significantly, possibly coming to an end of second phase (new diagnosis down to zero) within a period of time. Since March, hopefully the economy will begin to recover, along with continued easing of monetary, fiscal and industrial policies.

At present, Chinese stocks show improvement in fundamentals and a comparative advantage in terms of valuation and earnings growth. From March to April, Chinese stocks market is expected remain volatile. Throughout the year, we are cautiously optimistic.

As thematic opportunities cool down, the dominant factors returned to the basic logic of the economy and industry. We will continue to focus on leading companies in the fields of 5G, electronics, games, new energy, new energy vehicles, military industry, medicine, new retail, and logistics, etc. At the same time, we will seek cost-effective investment opportunities and timing in combination with marginal changes in fundamentals.

Disclaimer

The information and data provided in this document is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial products or services. This document is not intended for distribution to, or usage by, any person or entity in any jurisdiction or country where such distribution or usage are prohibited by local laws/regulations. The contents of this document are based upon sources of information believed to be reliable at the time of publication. Except to the extent required by applicable laws and regulations, there is no express or implied guarantee, warranty or representation to the accuracy or completeness of its contents. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Rosefinch (or its associated companies’) products. All rights are reserved by Rosefinch Investment Management Corp. and its affiliates.