Review of 2020H1

In contrast to Q1, global safe-haven assets performed worst in Q2, with interest rates on 10-year Chinese, US, German and Japanese government bonds rising across the board. The US dollar index suffered the longest consecutive decline since 2018, with the largest decline exceeding 7%. Gold prices fluctuated at high levels. Risky assets rebounded sharply in Q2. Major stock indexes around the world rallied and returned to their pre-pandemic levels. The Nasdaq broke another record high and exceeded 10,000 points, and the China GEM Board hit a new high after the 2016 meltdown. Brent Crude (ICE) price rose more than 100% from its lowest point to above $40 / BBL. Asset price increase requires loose monetary environment. The US started fiscal deficit monetization and the People's Bank of China launched a number of monetary policy tools. Monetary easing turned into credit easing and money continued to flow into the real economy from the financial market, avoiding the liquidity trap in major economies. Although the world is in the grip of a pandemic that has yet to recover, optimists believe that the global economy may have bottomed out.

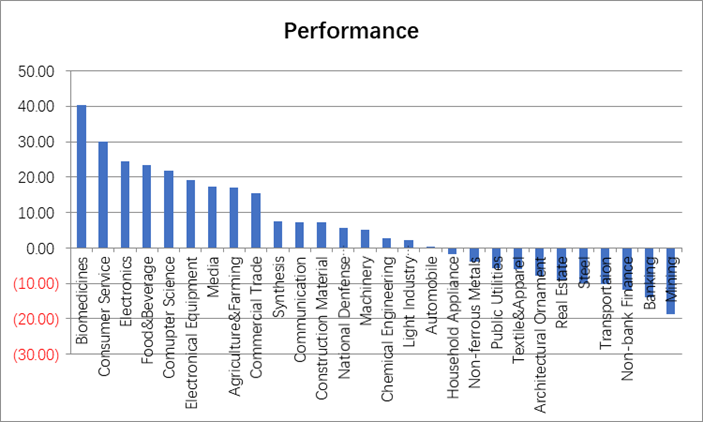

During the first half of the year, the majority of stocks fell globally, while the China Growth Enterprise Index has risen 35.59%, leading global amount of increase.

Source: Wind, 2020/1/1-2020/6/30

A-share market is sharply divided, with pharmaceutics, leisure service, electronics technology, food and beverage, and computer science engineering industries leading the gains.

Source: Wind, 2020/1/1-2020/6/30

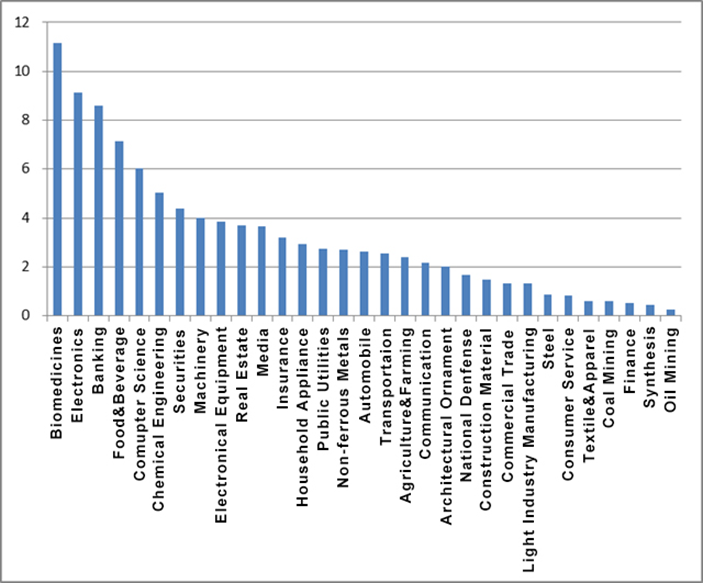

As driving force of Chinese economy transforms from investment to consumption, the structure of A-share market is changing. At the beginning of last year, the traded market value of pharmaceutics, electronics technology, food, computer science engineering, and media industries accounted for less than a quarter of the total market value. Now it has exceeded 40% and is expected to rise above 50%at the end of this year with upcoming IPOs. As the proportion of cyclical industries decreases, the volatility of A-share market will decline.

Source: Wind, as of 2020/6/30

Driving force of A-shares:

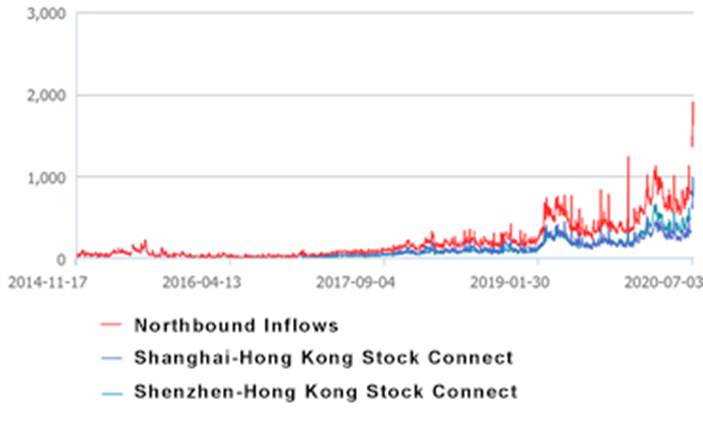

Loose liquidity: In response to the impact brought by COVID-19, Chinese Central Bank has adopted moderately loose monetary policy, more disciplined than overseas. In addition, household assets are transferring to securities market owing to “money effect”. In 2020H1, mutual fund industry raised more than 1 trillion RMB , of which equity funds accounts nearly 70%. Moreover, northbound inflows of foreign capital into the A-share market via China's stock connect reached 118.2 billion yuan, an increase of approximately 23% over last year.

Source: Wind, as of 2020/7/8

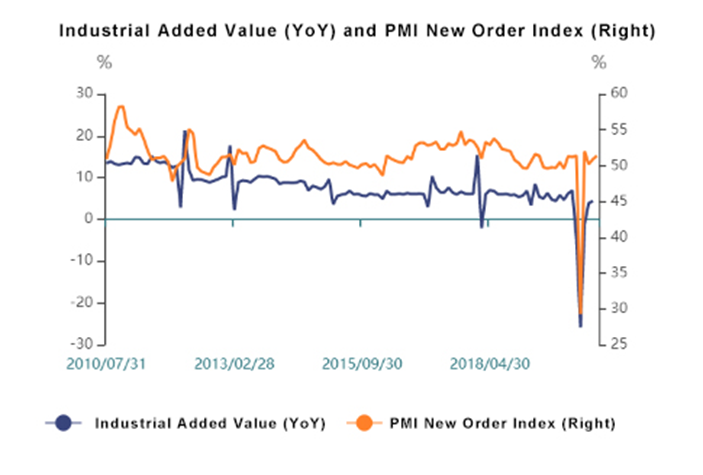

Expectations for economic recovery: At the beginning of the year, the outbreak of the COVID-19 left the domestic economy in shock for a short period of time. According to the industrial added value and PMI data since the second quarter, we believe that the domestic economy has gradually recovered from the trough, starting from February and March. Economic recovery is the main reason for the market rise and the recent style switch.

Source: as of 2020/7/8

Expectations of capital market reform: A-shares market was the product of reform, and is shouldering the mission of advancing the reform. In order to promoting financial supply-side reform, improve the efficiency of allocation of resources by market, advance state-owned enterprises reform, and advance the internationalization of the RMB, China needs a more mature capital market. Since last year, reform policies including delisting, registration, and refinancing have been implemented in succession.

The significance of the capital market has also been largely improved, leading to increasing risk appetite.

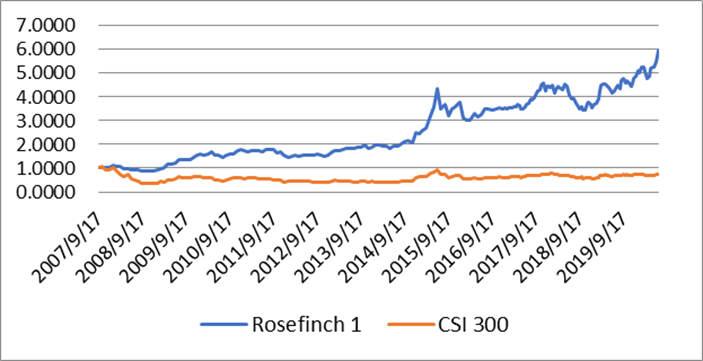

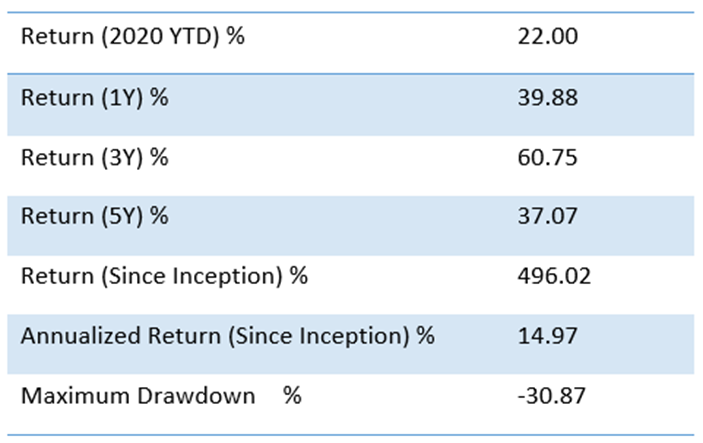

Performance

Source:Rosefinch,9/17/2007-6/30/2020

Source: Rosefinch, as of 2020/6/30

Outlook of 2020H2

Since the rebound in mid-to-late March, pharmaceutics, consumption and technology industries lead the rise. Value stocks that are highly relevant to the macro economy underperformed. With value stocks’cost performance ascending and investors’ confidence in economic recovery increasing,market style swifts recently. Looking ahead, we believe that:

1) Different from 2015, in which small-cap companies led the rise, 2020 witnesses the rise oflarge-cap companies, which is healthier.

2) The main driving force of the domestic economy shifts from investmentto consumption after 2015. Meanwhile, COVID-19 has accelerated Internet penetration in consumption. In this case, the market performance leading by growth companies stays in line with the major changes in the domestic economic structure;

3) The major problem with growth stocks is the decline in cost performance. Starting from March, many large-cap stocks have more than doubled in just three months.We believe the stock prices are likely to adjust in the short run;

4) Value stocks that are highly relevant to the economy, including automobiles and finance, dropped in both performance and valuation. With COVID-19 under control, reform policies advancing, we could expect a recovery in the short run. In the long run, investment opportunies lie in the four major industrial chains (Advanced Manufacture, TMT,Big consumption, Health care), which are closely related to economic transformation and upgrading.

In the long run, leading companies that lead and benefit from China's economic transformation and upgrading have large market value space. Their influence on the overall market and index will grow as their market share increase. In recent years, while overseas funds are increasing the allocation of RMB assets, Chinese households are also accelerating the allocation of financial assets. The stock market is expected to usher in a slow and long bull market.

The external environment is relatively friendly to emerging markets and Chinese market in the second half of the year, given the moderate economic repair in Europe and the US, the relatively loose policies of major central banks and the weakening dollar. In China, the pandemic has been strictly guarded, public health is relatively safe, and the economy has taken the lead in recovery. Fiscal and monetary policies have basically returned to normal. Reform and opening up policies continue. Marketization, legalization and internationalization of the financial market are strengthened. Chinese market including Hong Kong market is at low valuations, which is attractive for overseas investors.

Disclaimer

The information and data provided in this document is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial products or services. This document is not intended for distribution to, or usage by, any person or entity in any jurisdiction or country where such distribution or usage are prohibited by local laws/regulations. The contents of this document are based upon sources of information believed to be reliable at the time of publication. Except to the extent required by applicable laws and regulations, there is no express or implied guarantee, warranty or representation to the accuracy or completeness of its contents. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Rosefinch (or its associated companies’) products. All rights are reserved by Rosefinch Investment Management Corp. and its affiliates