Macroeconomy: a stabilizing economy with stabilizing company earnings

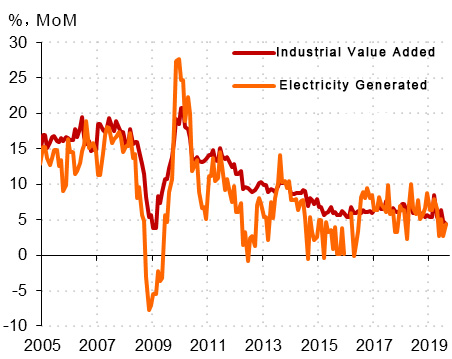

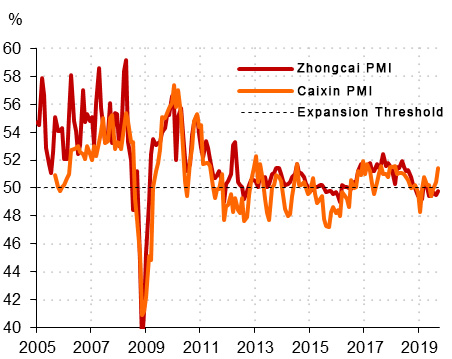

In the first three quarters of 2019, China’s GDP growth was 6.2% (YOY). China’s Enterprise of Designated Size’s Industrial Value-Added figure for the 8-month period experienced 5.6% real growth (YOY). September’s PMI was 49.8%, rising 0.3 percentage point from the previous month. The Big-Six Electricity Generation Companies’ Coal Consumption for September grew 1.9% (YOY), the second time this indicator has recorded positive growth this year, suggesting a recovery in the industrial sector.

Source: Wind

Monetary Policy: No change in current stance in the short-run, no change to the loose-policy trend in the long-run

On September 16th, China’s Central Bank implemented a comprehensive cut in the requirement reserve ratio, releasing RMB 900 billion, according to the Central Bank’s announcement, showing a significant degree of easing in monetary policy. Whilst maintaining strict control of the real estate sector, this reserve ratio cut intends to direct liquidity to the manufacturing sector, small and micro-enterprises, privately-owned enterprises and other policy-supported groups, in order to achieve structural credit easing.

We estimate that the probability of further easing in monetary policy is small in the near future. With rising inflation levels taken into consideration too, short term interest rates may face a certain degree of upward pressure. The next key observation point for monetary policy signals is the Fourth Plenary Session of the 19th Central Committee of the Communist Party of China held at the end of October, where the government will set the tone for the economy and corresponding policy for the next period. Looking ahead, with global economic growth slowing and the global trend of easing policy, as well as the slowdown in China’s economic fundamentals, domestic monetary policy is progressively transitioning into a loose stance.

Financial Sector Reform: with continued implementation of favorable policy, the ‘deepening of reform’ program is taking shape

The supply-side reform in the financial sector aims at allocating resources through the market mechanism, destructing the rigid payment phenomenon and the removal of systemic risk. The newly launched ‘STAR Market’ has given rise to reform in fundamental mechanisms covering IPOs, trading and information disclosure, in turn improving the quality of listed companies, increasing the costs of regulation violation, promoting the responsibleness of securities market intermediaries and refining the investor-protection mechanism.

The real estate sector is no longer to be used as a short-term economic stimulation tool, with countercyclical adjustment tools becoming more diversified. The introduction of the Loan Premium Rate mechanism cuts borrowing rates for large SOEs, thus increasing the will of banks to lend to SMEs, achieving a ‘rate cut’ effect. The impact from tax cuts and fee reductions, in addition to ‘special-purpose’ bond issues continues to appear. This year to date, RMB 2 trillion of tax cuts and fee reductions have been implemented as scheduled, continuing to reduce the burden on companies and boost their growth and development. Of this year’s planned RMB 2.15 trillion of ‘special-purpose’ bond issues, 60% has already been issued. Furthermore, a part of next year’s quota for ‘special-purpose’ bond issues has been brought forward, ensuring effectiveness from the very start of the year in order to support the real economy.

Capital Market Allocation: Risk assets are attractive, foreign capital continues to inflow

With the tight regulation on real estate and the destruction of rigid payments, risk assets are even more attractive, with the ‘earnings effect’ starting to appear. With an increase in the elastic float of the currency, as well as increased liquidity globally, overseas investors’ appetite for Chinese assets has risen.

Foreign capital is a major source of capital inflow into China’s A shares market. Since August, three global index companies, MSCI, FTSE Russel and S&P Dow Jones Indexes, announced the inclusion/increase in A shares market weights in their respective indexes. According to estimates, this period of concentrated inclusions and weight increases will lead to an inflow of over USD 80 billion of capital into the A shares market.

Investment direction:

40 years on since the ‘Reform and Opening’ policy was introduced, China has developed a relatively complete system of industries, with many globally competitive companies having emerged, possessing enormous investment value. Specifically, we favor those industries that are driving the global economy and society forward, focusing on the superior Chinese companies within those industries. Such industries include solar photovoltaic, alternative energy vehicles, electronics, communications, AI, cloud computing, big data, innovative medicine and medical treatment/health, software information services etc. Furthermore, we also seek China’s equivalents to those industry-leading companies of developed countries that emerged during their respective development. Those industries include consumer goods, non-bank financial institutions, military, seed, household, internet platforms etc. Moreover, focus is also placed on those companies in specific industry segments within the large Chinese market that have significant growth and earnings potential. Those industry segments include livestock, pesticides, ecological restoration etc. Finally, when the economy reaches the bottom of its growth cycle, we also closely follow those highly cyclical industries for potential investment opportunities, for example, lead, zinc and steam fuels.

Disclaimer

The information and data provided in this document is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial products or services. This document is not intended for distribution to, or usage by, any person or entity in any jurisdiction or country where such distribution or usage are prohibited by local laws/regulations. The contents of this document are based upon sources of information believed to be reliable at the time of publication. Except to the extent required by applicable laws and regulations, there is no express or implied guarantee, warranty or representation to the accuracy or completeness of its contents. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Rosefinch (or its associated companies’) products. All rights are reserved by Rosefinch Investment Management Corp. and its affiliates.