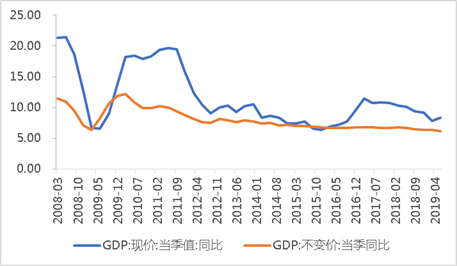

Macroeconomy: a stabilizing economy with stabilizing company earnings

China's National Bureau of Statistics reports GDP growth of 6.3% for the first half of 2019, with Q2 growth at 6.2% (YOY). June's house sales, housing starts and housing investment dropped back further, continuing in their downward trend. On the other hand, capital construction investment and manufacturing industry investment both recovered slightly, whilst car sales bounced back significantly, speeding up the recovery of total retail sales of consumer goods. Overall, demand-side statistics outperformed forecasts. At present, potential drawbacks on demand stem from trade-war related shocks on exports and the real estate industry.

With house prices having already experienced a 4-year upward cycle, in addition to the central governments' comprehensive regulatory policy of 'houses for living-in, not for speculative investment', the pressure on the real estate industry is considerable, from house sales through to financing channels and costs. However, such policy is beneficial in facilitating the government in achieving its long-term objective of controlling risk in the financial system.

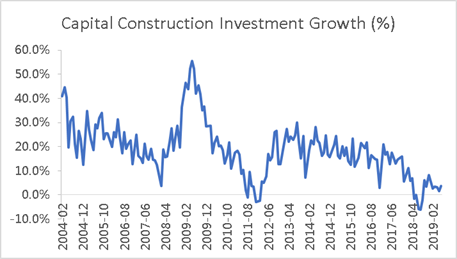

We expect a progressive increase in the impact from countercyclical policy adjustments throughout Q3. For example, resulting from the successive issues of‘special bonds', we believe the probability of a continued recovery in capital construction investment is high. Furthermore, credit easing over the larger economy in addition to the ongoing implementation of the central government's plan to cut taxes and reduce fees, means a continued rise in manufacturing industry investment can be expected.

Stabilizing Economy

Source: Wind

Recovering Capital Construction Investment

Source: Wind

Monetary Policy: promoting a fall in actual loan rates and maintaining rational levels of liquidity

The Central Politburo's meeting in July stated that the tightness of monetary policy must be set appropriately, maintaining an adequate and rational level of liquidity. China has two interest rates, a market interest rate and a benchmark loan and deposit interest rate. Whilst the market interest rate has been falling since last year, the magnitude of the fall in the benchmark loan interest rate is significantly smaller, revealing the existence of a‘double-track' interest rate, and highlighting the inefficiency of the monetary policy transmission mechanism. During an interview, the Governor of the Central Bank, Yi Gang, stated that the pricing mechanism of the actual loan rate must undergo further reform, with a transfer from the existing benchmark rate to the market-priced rate, whilst making reference to the other market-determined rates such as that of the medium-term lending facility (MLF) etc.

Capital Market Reform: A smooth start to the SSE STAR market signals its potential as a catalyst for market-wide reform

According to Haitong Securities, the SSE STAR market's individual stocks' average first-day relative issue price growth and market-opening price growth was 139.6% and 1.0% respectively. The average first-week relative issue price growth and market-opening price growth was 140.2% and 2.4% respectively. The first week's transaction volume totaled 142.9 billion RMB, accounting for 7.6% of the total A shares market volume that week.

This initial-period performance of the SSE STAR market is similar to that of the previously introduced GEM Board (a Chinese market for innovative companies temporarily unable to list on the Main Board): a smooth start with negligible impact on existing markets. The introduction of the SSE STAR market is a major step in promoting the A shares market's global status and companies' access to direct financing, as well as an effective catalyst in the reform of China's capital markets, with the potential to increase investors' risk appetite.

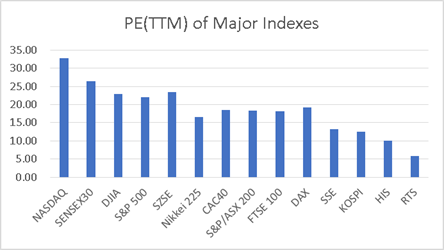

Capital Market Allocation: A shares allocation increasingly attractive, drawing in investors' capital

The Central Politburo's meeting in July made clear that the real estate industry will not be used as a short-term economic stimulation tool, conforming with the government's long-term management mechanism of the housing industry. Consequently, there is potential for additional capital to flow into the A shares market.

The long-term trend of a change in households' savings allocation is increasingly apparent. Different expectations and popular investment strategies are transforming how households allocate their assets. According to statistics, in the first 6 months of 2019, foreign investors net increase in investment in domestic bonds and stocks totaled 49.3 billion USD, of which 41.6 billion USD was in bonds and 7.8 billion USD was in stocks.

Looking globally, the Shanghai Composite Index valuation (PE) is low at 13.21, with the overall A shares market amongst the lowest valued markets globally, signaling further that A shares are cheap. The recently released 'Article 11', directed at promoting the opening-up of China's finance industry to international participants, has the potential to boost the inflow of foreign capital, increasing liquidity.

Source: Wind, 7/31/2019

Fourty years on since the‘Reform and Opening' policy was introduced, China has developed a relatively complete system of industries, with many globally competitive companies having emerged, possessing enormous investment value. Specifically, we favor those industries that are driving the global economy and society forward, focusing on the superior Chinese companies within those industries. Such industries include solar photovoltaic, alternative energy vehicles, electronics, communications, AI, cloud computing, big data, innovative medicine and medical treatment/health, software information services etc. Furthermore, we also seek China's equivalents to those industry-leading companies of developed countries that emerged during their respective development. Those industries include consumer goods, non-bank financial institutions, military, seed, household, internet platforms etc. Moreover, focus is also placed on those companies in specific industry segments within the large Chinese market that have significant growth and earnings potential. Those industry segments include livestock, pesticides, ecological restoration etc. Finally, when the economy reaches the bottom of its growth cycle, we also closely follow those highly cyclical industries for potential investment opportunities, for example, lead, zinc and steam fuels.

Disclaimer

The information and data provided in this document is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any financial products or services. This document is not intended for distribution to, or usage by, any person or entity in any jurisdiction or country where such distribution or usage are prohibited by local laws/regulations. The contents of this document are based upon sources of information believed to be reliable at the time of publication. Except to the extent required by applicable laws and regulations, there is no express or implied guarantee, warranty or representation to the accuracy or completeness of its contents. Investment returns are not guaranteed as all investments carry some risk. The value of an investment may rise or fall with changes in the market. Past performance is no guarantee of future performance. This statement relates to any claims made regarding past performance of any Rosefinch (or its associated companies’) products. All rights are reserved by Rosefinch Investment Management Corp. and its affiliates.