Through its growth and development in-step with China's economy and capital markets, Rosefinch has established and refined a fundamental philosophy upon which it bases its investment strategy, laying the foundations for the creation of significant risk-adjusted returns for its investors.

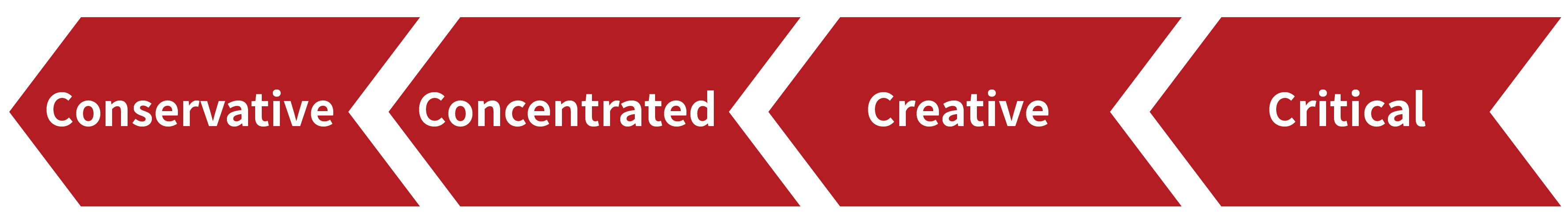

l Conservative

Upholding its principle of conservatism, Rosefinch persists in value investment and prudent decision-making, seeking high certainty in returns through the implementation of its integrated risk management system. Following the discovery and careful tracking of intrinsic value, investment expertise facilitates the following strategic decisions that are made.

l Concentrated

Rosefinch aims to be experts in the industry-chains of its target stocks, with an understanding of target companies comparable to that of their respective management teams. Rosefinch is rational in and concentrated on the in-depth investment research upon which it discovers value and generates sustainable returns for its investors.

l Creative

A creative mindset and approach are required in the excavation of the huge value within China's reforming economy. Innovation is a key theme in today's China, not only manifesting in the real economy, but also in Rosefinch's strategy as an asset manager.

l Critical

Rosefinch is farsighted in its judgement and independent in its critical analysis. The rapid growth and extreme volatility of emerging markets has induced Rosefinch to enhance its critical evaluation capabilities, carefully judging major trends and the value investment opportunities that can be discovered within.

Follow our WeChat

Follow our WeChat